Welcome to DownEaster

Your Partner in Delivering Innovative Solutions for Websites, Mobile Apps, Social Media, e-Commerce, Cybersecurity, Software Development, and Gaming Experiences.

Our Expertise

Mobile App Development

We build custom mobile apps that are tailored for your business needs. Whether it is an iOS or Android app, we leverage our expertise to deliver a seamless and compelling user experience.

Web App Development

When it comes to web apps, we are experienced in developing highly responsive and functional apps on React JS and WordPress.

E-Commerce Development

We can develop several wonderful e-commerce sites using Magento, Shopify, Woocommerce along with facilitating admin panels, payment gateway, cart, user verification features.

Machine Learning

We employ advanced machine learning algorithms to extract meaningful insights and drive informed decision-making. Whether it's predictive analytics, NLP, or image recognition, our solutions are designed to propel your business into the future.

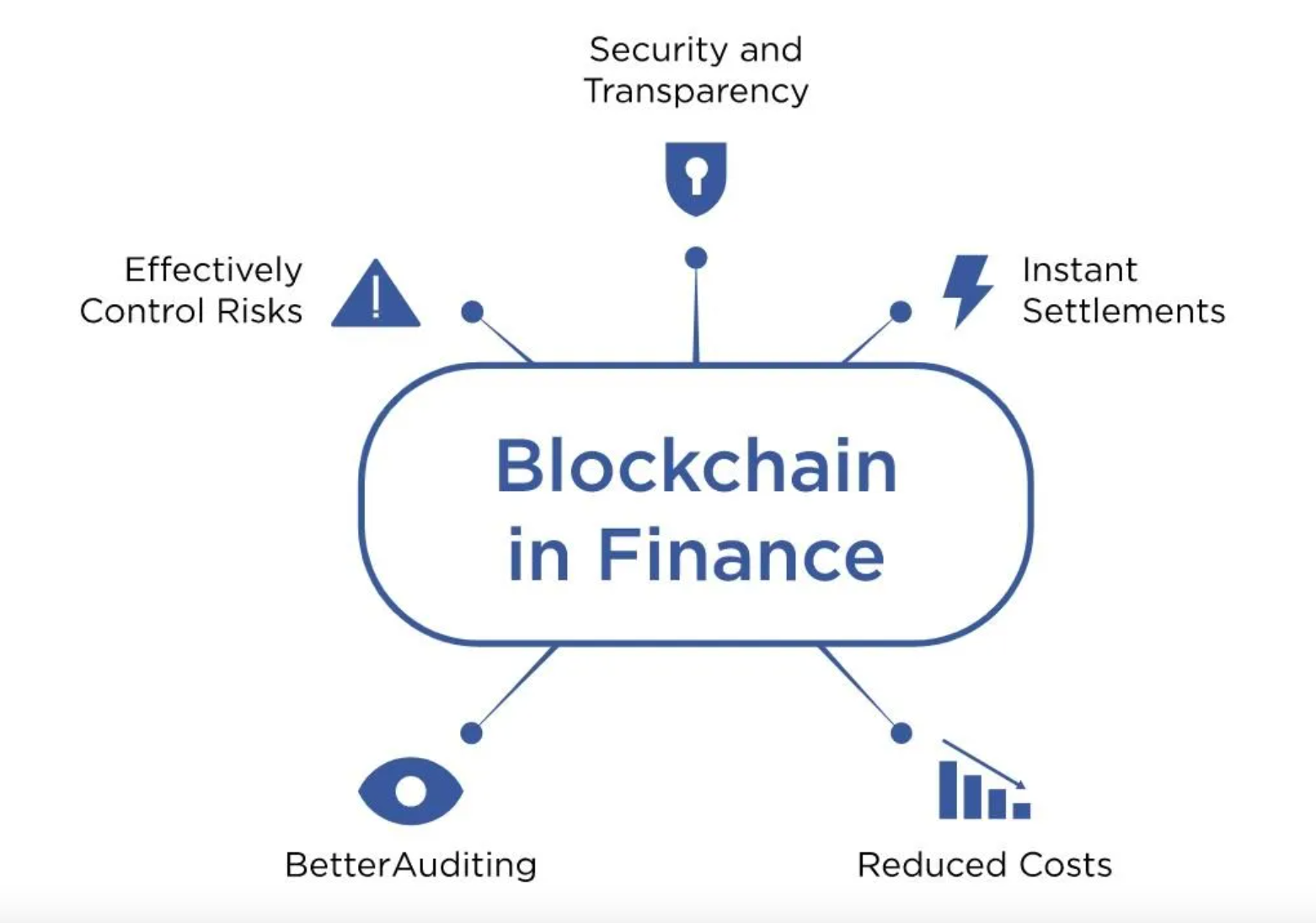

Blockchain

Enter the world of decentralized trust and transparency with our bespoke blockchain solutions. We specialize in developing secure, scalable, and interoperable blockchain applications that redefine how transactions and data are managed across industries.

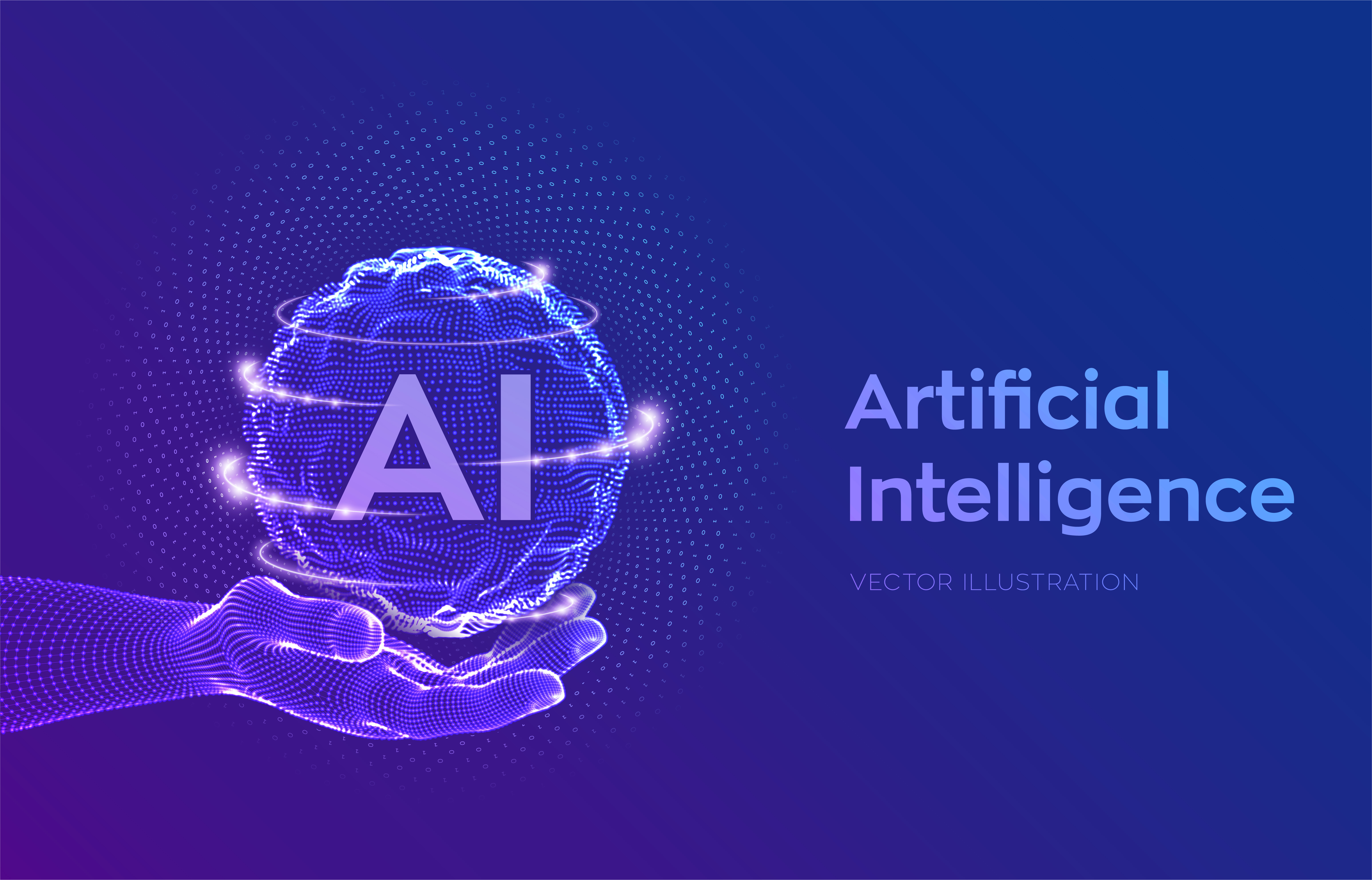

AI (Artificial Intelligence)

Embrace the era of intelligent automation with our AI-driven solutions. From chatbots that enhance customer engagement to automated processes that streamline your operations, our AI expertise empowers your business to stay agile in a rapidly evolving landscape.

UI/UX Design and Gaming

Enhance your digital presence with visually stunning, user-friendly UI/UX designs and innovative gaming solutions. From wireframing to prototyping, we create seamless, engaging experiences that elevate your brand’s functionality and aesthetics.

Quality Assurance (QA) and Testing

Ensure the seamless performance and reliability of your software with our Quality Assurance (QA) and Testing services. Our dedicated team employs rigorous testing methodologies to identify and address potential issues, ensuring the delivery of high-quality, secure, and fully functional solutions. Trust us to meticulously assess and enhance the quality of your software, providing a robust foundation for your digital success.

Cybersecurity Services

Incorporated into our services is a specialization in securing software and systems. We provide dedicated solutions encompassing meticulous threat detection, penetration testing, and the implementation of diverse security measures.

Maintenance and Support Services We Provide

New Feature Implementation

Bug Fixes

App Updates

Operating System & Library Updates

Code Maintenance

Data Migration

App Monitoring Services

Performance Enhancements

Application Security Management

UI/UX Improvements

Server Supervising

Auto Back-up

About

DownEaster: Innovation for Everyone

At DownEaster, we thrive on Creativity, Innovation, and Accessibility. By challenging conventions and prioritizing inclusive, user-friendly solutions, we empower everyone while championing equal opportunity. Innovation isn’t just our goal— it’s our mission.

Do it your way. Join us as we break boundaries and make groundbreaking ideas accessible to all.

Portfolio

At As You Are Psychotherapy & Wellness, they are dedicated to guiding you through your personal journey with empathy and expert care, customized to meet your unique needs. Their compassionate therapists provide a safe and welcoming environment where acceptance, growth, and healing come together. Whether you're seeking individual therapy, family counseling, or wellness support, their team is ready to help you navigate life's challenges with understanding and care.

We are currently involved in a custom software development project with PenBank Inc., a private development bank based in the Philippines. The project is centered around the creation of their CORE Banking Services, which includes the development of CIF (Client Information File) and ROPA (Real and Other Properties Acquired System).Penbank provides financial services to small businesses, farmers, and local communities, helping them with various banking needs such as loans, savings, and investments. PenBank ia a member of the Rural Bankers Association of the Philippines.

Team

Mohit

Chief Technology Officer

Meet Mohit, a tech enthusiast whose dedication to technology is equaled by his deep passion for cricket. Excelling in coding and innovation, he discovers solace and joy on the cricket field, effortlessly merging technical expertise with his love for the sport. His well-rounded nature infuses a distinctive energy into every team and project he embraces.

Rhaniel

Chief Software Officer

Meet Rhaniel, an IT professional with 25 years of experience in managing Quality Standards, Testing, Validation, Process Improvement, Documentation, Collaboration, Compliance, Risk Management and Tool Evaluation. In addition, Rhaniel serves as a strategic partner in the Philippines, leveraging his extensive network and industry insights to drive growth and success for our organization. Beyond his IT expertise, he's an avid basketball enthusiast, effortlessly combining technical skills with a love for the game on the court.

Rohit

Software Developer

Meet Rohit, a software engineer with a talent for creating top-notch solutions. He loves solving problems and pays attention to every detail. Rohit is great at making efficient and innovative software applications. His commitment to keeping up with the latest technologies makes him a valuable part of any team.. His passion for cricket seamlessly complements his technical expertise showcasing a well-rounded individual capable of both building robust applications and thriving in the world of sport.

Benz

Chief Cybersecurity Officer

Meet Benz, an engineer with over 30 years of experience as a Systems and Network Administrator, Benz has evolved into a trusted Cybersecurity Specialist, known for his expertise in safeguarding digital environments. Outside work, he enjoys home DIY (do it yourself) projects, turning ideas into reality while recharging through hands-on creativity. Benz also values family time, creating lasting memories through road trips and beach outings, embracing life’s simple pleasures.

Franchie Lagmay

Product Designer

Specializing in UI/UX and Gaming

Meet Franchie, a multidisciplinary visual artist with over 13 years of experience in UI/UX and web design, graphic design, and illustration. She holds a Master of Arts (MA) in Art Therapy and a Bachelor of Fine Arts (BFA) in Visual Communication, graduating Magna Cum Laude. An active member of Phi Kappa Phi, Franchie is passionate about engaging with the artistic community and contributing to its development. Outside of her professional work, she enjoys participating in Game Jams with friends and playing badminton.

Helena Artates

Co-Head UI/UX

Digital Designs

Meet Helena, a Product Manager who achieved distinction with a Bachelor of Arts from The Creative School at Toronto Metropolitan University. Her academic excellence seamlessly integrates with her role, infusing product development and management with creative innovation and strategic insight. Outside of work, she finds joy in practicing pilates and yoga.

Clifford Callueng

Legal

Meet Atty. Clifford, a seasoned lawyer with expertise in Corporate and Business Law, Commercial Contracts, Intellectual Property Law, Labor and Employment Law, Regulatory Compliance, Real Estate Law, Litigation, and Dispute Resolution, encompassing criminal and civil law. In addition to his role as a lawyer, he serves as a strategic partner in the Philippines,using his network and expertise to drive our organization's growth and success. Beyond his legal pursuits, he enjoys quality time travelling with his family.

Vic Artates

Founder & CEO

Meet Vic, the founder of DownEaster and YourTita, who combines entrepreneurial vision with hands-on caregiving experience. A graduate of Harvard Business School Online’s Entrepreneurship Essentials, he combines leadership with a deep understanding of technology and compassion-driven solutions. With a background in accountancy, finance, and mobile web development, Vic is committed to transforming industries through innovation. Outside of work, he enjoys running both short and long distances, having completed his first marathon and a backyard ultramarathon.

Our Blog

Power of AI

Artificial intelligence is the science of making machines that can think like humans. It can do things that are considered "smart."

IOS 17 Latest News

iOS 17 brings big updates to Phone, Messages and FaceTime that give you new ways to express yourself as you communicate.

Hacker can do...

Hacking is not always a malicious act, but it is most commonly associated with illegal activity and data theft by cyber criminals.

Explore All Blogs

Welcome Downeaster

Unleash your ideas with us! From local ventures to global enterprises, we specialize in AI, Machine Learning, Blockchain and crafting mobile app, e-commerce and websites platforms. Elevate your innovation journey with us. It should be “crafting” not “developing”. Thank you

In today's rapidly evolving financial landscape, staying ahead of the curve is essential for banks and financial institutions. As the industry faces increasing pressure to enhance security, streamline processes, and provide personalized services, many are turning to Artificial Intelligence (AI) for solutions. Let's delve into how AI is reshaping the banking sector, revolutionizing loans, client profiles, and database security.

Read More1.Enhanced Data Security:

AI-powered algorithms have the capability to analyze vast amounts of data in real-time, enabling financial institutions to detect and prevent security threats more effectively. By continuously monitoring databases for suspicious activities and potential breaches, AI can bolster data security and protect sensitive client information from cyber threats.

2. Streamlined Loan Processes:

AI streamlines loan processes by automating manual tasks and decision-making processes. AI-powered algorithms can analyze client data, assess creditworthiness, and make lending decisions in a fraction of the time it would take a human loan officer. This efficiency not only speeds up loan approvals but also improves the borrower experience and reduces operational costs for financial institutions.

3.Personalized Customer Experiences:

AI enables financial institutions to gain deeper insights into their clients' behaviors, preferences, and financial needs. By analyzing client profiles and transaction histories, AI algorithms can offer personalized recommendations and tailored financial solutions, enhancing the overall customer experience and driving customer satisfaction and loyalty.

4.Predictive Analytics:

AI algorithms analyze historical data to predict future trends and client behaviors, enabling financial institutions to make more informed decisions and anticipate their clients' needs. By leveraging predictive analytics, financial institutions can proactively offer relevant products and services to their clients, increasing customer engagement and retention.

5.Continuous Monitoring and Improvement:

One of the key advantages of AI is its ability to learn and adapt over time. AI algorithms continuously monitor data and adjust their models based on new information, improving accuracy and effectiveness over time. This continuous monitoring and improvement cycle ensures that financial institutions can stay ahead of emerging threats and provide the highest level of security and service to their clients.

• Conclusion:

In conclusion, AI holds immense promise for revolutionizing loans, client profiles, and database security in the banking sector. By leveraging AI-powered solutions, financial institutions can enhance data security, streamline loan processes, provide personalized customer experiences, and make data-driven decisions that drive growth and success. As the industry continues to embrace AI technology, the future of banking looks brighter and more secure than ever before.

Securing Financial Futures: How Blockchain Revolutionizes Loans, Client Profiles, and Database Security for Banks and Financial Institutions

In the ever-evolving landscape of banking and finance, security and trust are paramount. As banks and financial institutions strive to protect sensitive client data and streamline loan processes, they are turning to innovative technologies like blockchain for solutions. Let's explore how blockchain is reshaping the industry, bolstering security, and revolutionizing client profiles and database security for financial institutions.

Read More1.Enhanced Data Security:

Traditional databases are vulnerable to cyberattacks and data breaches, putting sensitive client information at risk. Blockchain technology offers a decentralized and immutable ledger system, where data is stored across a network of computers, making it virtually impervious to hacking and tampering. By leveraging blockchain, financial institutions can enhance data security, ensuring that client profiles and loan data remain secure and confidential.

2. Immutable Transaction Records:

Blockchain's immutable nature ensures that once data is recorded on the blockchain, it cannot be altered or deleted. This feature is particularly valuable in loan transactions, where a transparent and auditable record of all transactions is essential. By utilizing blockchain for loan processing, financial institutions can create a tamper-proof audit trail, reducing the risk of fraud and ensuring compliance with regulatory requirements. Streamlined Loan Processes: Blockchain technology enables the automation of loan processes through smart contracts, self-executing contracts that automatically enforce predefined terms and conditions. Smart contracts streamline loan origination, approval, and disbursement processes, eliminating the need for manual paperwork and reducing processing times. This efficiency not only improves the borrower experience but also lowers operational costs for financial institutions.

3.Enhanced Identity Verification:

Blockchain-based identity verification systems offer a secure and decentralized solution for verifying client identities. By leveraging cryptographic techniques, blockchain can securely authenticate client identities, reducing the risk of identity theft and fraud. Financial institutions can use blockchain to create digital identities for clients, allowing for seamless and secure access to financial services.

4.Improved Regulatory Compliance:

Compliance with regulatory requirements is a top priority for financial institutions. Blockchain technology facilitates regulatory compliance by providing a transparent and auditable record of all transactions. Financial institutions can easily demonstrate compliance with anti-money laundering (AML) and know your customer (KYC) regulations by leveraging blockchain's immutable ledger.

• Conclusion:

In conclusion, blockchain technology holds immense promise for enhancing security, efficiency, and transparency in the banking and finance sector. By leveraging blockchain for loans, client profiles, and database security, financial institutions can build trust with their clients, streamline processes, and ensure compliance with regulatory requirements. As the industry continues to embrace blockchain technology, the future of banking and finance looks brighter and more secure than ever before.

.png)

Transforming Finance: The Power of Machine Learning in Banking and Financial Institutions

In today's digital age, banks and financial institutions are under increasing pressure to innovate and adapt to changing market dynamics while ensuring the security and privacy of client data. Machine learning, a subset of artificial intelligence, is emerging as a transformative technology that holds the potential to revolutionize various aspects of the financial sector. Let's explore how machine learning is reshaping the industry, particularly in the areas of loans, client profiles, and database security.

Read More1.Enhanced Credit Risk Assessment:

Machine learning algorithms analyze vast amounts of data to assess credit risk more accurately and efficiently than traditional methods. By analyzing historical loan data, client profiles, and market trends, machine learning models can identify patterns and predict the likelihood of default with greater precision. This enables financial institutions to make more informed lending decisions, reducing the risk of loan defaults and improving portfolio performance.

2. Personalized Customer Experience:

Machine learning algorithms analyze customer data to gain insights into individual preferences, behaviors, and financial needs. By leveraging this information, financial institutions can offer personalized product recommendations, tailored financial advice, and customized service offerings to each client. This not only enhances the customer experience but also strengthens client relationships and fosters loyalty.

3. Fraud Detection and Prevention:

Machine learning algorithms can detect fraudulent activities by analyzing transactional data in real-time and identifying suspicious patterns or anomalies. By continuously monitoring transactions and client behavior, machine learning models can flag potential fraudulent activities for further investigation, enabling financial institutions to mitigate risks and protect against financial losses.

4.Improved Database Security:

Machine learning algorithms can enhance database security by identifying vulnerabilities, detecting potential threats, and predicting cyberattacks. By analyzing network traffic, user behavior, and system logs, machine learning models can proactively identify and respond to security breaches, preventing unauthorized access to sensitive data and minimizing the impact of cybersecurity incidents.

5. Predictive Analytics:

Machine learning enables financial institutions to leverage predictive analytics to forecast future market trends, customer behavior, and business outcomes. By analyzing historical data and identifying patterns, machine learning models can generate insights that inform strategic decision-making, risk management, and resource allocation, helping financial institutions stay ahead of the competition and seize opportunities for growth.

• Conclusion:

In conclusion, machine learning offers immense potential to transform banking and financial institutions by improving credit risk assessment, personalizing customer experiences, enhancing fraud detection and prevention, strengthening database security, and enabling predictive analytics. As the adoption of machine learning continues to grow, financial institutions that embrace this technology will gain a competitive edge, drive innovation, and deliver greater value to their clients.

Navigating the Mobile App Ecosystem: Unveiling the Spectrum of Mobile App Services

In the ever-evolving landscape of mobile technology, mobile apps have become an integral part of our daily lives. From communication and productivity to entertainment and health, mobile apps offer a diverse range of services. In this blog, we will delve into the world of mobile app services, exploring the various functionalities and features that make our smartphones indispensable.

Read More1. Understanding Mobile App Services:

Definition and Scope: What constitutes a mobile app service? • Importance in the Digital Age: How mobile app services have transformed the way we live and work.

2. Categories of Mobile App Services:

• Communication Apps: Messaging, Voice, and Video calling

applications.

• Productivity Apps: Tools for organization, task

management, and collaboration.

• Entertainment Apps: Streaming services, gaming platforms,

and content consumption apps.

• Utility Apps: Applications that serve specific purposes

like weather, navigation, and fitness tracking.

3. Exploring E-Commerce and Financial Services Apps:

• Mobile Banking: The evolution of banking services on

mobile platforms.

• Shopping Apps: E-commerce platforms and their convenience

for online shopping.

4. Health and Wellness Apps:

• Fitness Tracking: Apps for tracking workouts, nutrition,

and overall health.

• Telemedicine: The rise of virtual healthcare services

through mobile apps.

5. Customization and Personalization:

• Personal Assistant Apps: AI-driven virtual assistants and

their role in daily life.

• Customizable Apps: How users can tailor apps to suit their

preferences and needs.

6. Security and Privacy Concerns:

• Data Protection: Measures taken by mobile app services to

safeguard user information.

• Privacy Settings: Empowering users with control over their

data.

7. Emerging Trends in Mobile App Services:

• Augmented Reality (AR) and Virtual Reality (VR)

Applications.

• Integration of Artificial Intelligence (AI) for enhanced

user experiences.

8. Challenges and Future Prospects:

• Overcoming App Fatigue: Dealing with the overwhelming

number of apps available.

• The Future of Mobile App Services: Predictions and

potential advancements.

• Conclusion:

As we navigate through the multitude of mobile app services, it's evident that these applications play a crucial role in shaping our digital experiences. From simplifying daily tasks to providing entertainment and connectivity, mobile apps have become indispensable in our interconnected world. This blog aims to unravel the diverse spectrum of mobile app services, shedding light on their significance and the ever-evolving landscape they inhabit.

Mobile Banking Unveiled: Revolutionizing Finance in Your Palm

In an era dominated by smartphones, the realm of banking has undergone a transformative evolution with the advent of mobile banking services. This blog aims to provide a comprehensive exploration of mobile banking, unraveling the various services it offers, and highlighting the impact it has on the way we manage our finances.

Read More1. Defining Mobile Banking Services:

• Introduction to mobile banking and its fundamental

features.

• The shift from traditional banking to mobile-centric

financial services.

2. Key Features and Functionality:

• Account Management: Accessing and monitoring accounts

on-the-go.

• Fund Transfers: Instant money transfers between accounts

and individuals. • Bill Payments: Convenient utilities for

settling bills seamlessly.

• Mobile Deposits: Depositing checks using the smartphone

camera.

3. Security Measures in Mobile Banking:

• Two-Factor Authentication: Enhancing security with

multi-layered verification.

• Biometric Authentication: Fingerprint and facial

recognition for secure access. - Encryption and Secure

Communication: Protecting user data during transactions.

4. Financial Management Tools:

• Budgeting Apps: Tracking and managing expenses through

mobile apps.

• Transaction History and Alerts: Real-time updates on

account activities.

5. Contactless Payments and Mobile Wallets:

• NFC Technology: Enabling contactless payments with Near

Field Communication.

• Integration of Mobile Wallets: Storing cards and

facilitating cashless transactions.

6. Enhanced Customer Experience:

• 24/7 Accessibility: Banking services at the fingertips,

anytime, anywhere.

• Customer Support through Apps: Instant assistance and

query resolution.

7. Emerging Technologies in Mobile Banking:

• Artificial Intelligence (AI) and Chatbots: Personalized

banking experiences.

• Blockchain in Banking Apps: Exploring decentralized and

secure transactions.

8. Challenges and Regulatory Landscape:

• Security Concerns: Addressing the risks associated with

mobile banking.

• Compliance with Regulations: Navigating the regulatory

framework.

9. Future Trends in Mobile Banking Services:

• Integration of Augmented Reality (AR) for immersive

financial experiences.

• Evolution of Open Banking: Collaborations and

interconnected financial services.

• Conclusion:

Mobile banking services have redefined the way we interact with our finances, offering unprecedented convenience and accessibility. As technology continues to advance, the landscape of mobile banking will undoubtedly evolve, bringing forth new possibilities and challenges. This blog seeks to demystify the world of mobile banking, shedding light on its features, security measures, and the transformative impact it has on the traditional banking paradigm.

Decoding the Relationship: Is an App a Service or Something More?

As mobile applications have become an integral part of our digital lives, a common question arises: Is an app merely a standalone software or does it transcend into the realm of services? This blog aims to unravel the intricacies of this relationship, exploring the dynamic interplay between apps and services in the contemporary digital landscape.

Read More1. Defining Apps and Services:

• Clarifying the distinctions between standalone

applications and services.

• Understanding the basic characteristics of both.

2. Apps as Standalone Entities:

• Exploring the concept of apps as self-contained software. • Examples of standalone apps and their functionalities.

3. The Service Element in Apps:

• Unpacking the services embedded within mobile

applications.

• How apps go beyond basic functions to provide ongoing

value.

4. App Ecosystems and Interconnected Services:

• Integration with Cloud Services: Leveraging cloud-based

functionalities.

• Cross-Platform Synchronization: Seamless experiences

across devices.

5. Mobile App Services and User Interaction:

• User Engagement Features: Push notifications, in-app

messaging, and personalized experiences.

• App Updates and Service Improvements: How apps evolve to

meet user needs.

6. Transactional and Functional Services within Apps:

• In-App Purchases and Transactions: Monetization models

within apps.

• Functional Services: Offering tools, utilities, or

solutions beyond basic functionality.

7. The Role of APIs in App Services:

• Application Programming Interfaces (APIs) and their

significance.

• How APIs enable apps to connect with external services.

8. Service-Oriented Architecture (SOA) in App Development:

• Building apps with a focus on service-oriented principles.

• Microservices and their impact on app architecture.

9. Challenges in Distinguishing Apps and Services:

• Ambiguities in Terminology: Navigating the semantics of

app and service definitions.

• User Perspectives: How users perceive and interact with

apps as services.

10. The Evolving Landscape: Future Trends in App Services:

• Artificial Intelligence (AI) Integration: Smart and

adaptive app services.

• Augmented Reality (AR) and Virtual Reality (VR): Expanding

the experiential dimensions.

• Conclusion:

In the dynamic world of technology, the distinction between apps and services is often blurred. This blog aims to dissect this intricate relationship, shedding light on the multifaceted nature of mobile applications. Whether as standalone entities or as integral components of service ecosystems, apps play a pivotal role in shaping our digital experiences, and understanding this relationship is key to navigating the evolving landscape of technology.

Unveiling the Boundless Potential: The Power of Artificial Intelligence

In the realm of technology, there exists a force that is reshaping industries, revolutionizing processes, and redefining human capabilities – Artificial Intelligence (AI). The power wielded by AI transcends mere automation; it permeates through sectors, driving innovation, efficiency, and progress. In this blog, we embark on a journey to explore the profound impact and limitless potential of AI.

Read More1. Understanding AI:

At its core, AI refers to the simulation of human intelligence in machines, enabling them to perform tasks that typically require human cognition. This encompasses a spectrum of capabilities, from basic rule-based systems to advanced deep learning algorithms. By harnessing data and computational power, AI models learn, adapt, and make decisions with increasing accuracy and efficiency.

2. Transforming Industries:

AI is the catalyst for transformation across various sectors, from healthcare to finance, manufacturing to agriculture. In healthcare, AI-driven diagnostics enhance disease detection and treatment planning, while in finance, predictive analytics optimize investment strategies and risk management. Industries are leveraging AI to streamline operations, enhance customer experiences, and drive competitive advantage.

3. Empowering Innovation:

The power of AI lies in its ability to unlock new frontiers of innovation. From autonomous vehicles navigating complex environments to virtual assistants understanding and responding to natural language, AI is driving the next wave of technological advancement. Moreover, AI fosters creativity through generative models, enabling the creation of art, music, and literature.

4. Ethical Considerations:

As AI continues to proliferate, it raises important ethical considerations regarding privacy, bias, and accountability. Ensuring fairness and transparency in AI systems is paramount to building trust and safeguarding against unintended consequences. Ethical AI practices must prioritize human well-being, equity, and the responsible use of technology.

5. Shaping the Future:

The power of AI extends far beyond its current capabilities. As research progresses and technology evolves, AI holds the potential to tackle complex global challenges, from climate change to healthcare disparities. Moreover, AI-driven innovations such as augmented intelligence, human-machine collaboration, and decentralized autonomous systems are reshaping the future of work and society.

• Conclusion:

In conclusion, the power of AI is not merely confined to its technological prowess; it embodies a paradigm shift in how we perceive and interact with the world. As we harness its potential responsibly and ethically, AI has the capacity to drive unprecedented progress, empower human endeavors, and shape a brighter future for generations to come.

The Next Evolution of Apple's Mobile Operating System

iOS 17 marks yet another milestone in the journey of Apple's mobile operating system, bringing forth a plethora of new features, enhancements, and refinements to the iOS ecosystem. As Apple continues to innovate, iOS 17 promises to deliver an even more seamless, secure, and enjoyable user experience for millions of iPhone and iPad users worldwide.

Read More1. Revamped Interface Design:

With iOS 17, users can expect a fresh new look and feel across the entire system. Apple has refined the interface elements, icons, and animations to provide a more cohesive and visually appealing experience.

2. Enhanced Privacy Features:

Privacy has always been a top priority for Apple, and iOS 17 takes it a step further with additional privacy features and controls. From improved app tracking transparency to enhanced data protection measures, users can have greater peace of mind knowing their personal information is secure.

3. Augmented Reality (AR) Integration:

iOS 17 introduces further integration of augmented reality into the core of the operating system. With ARKit advancements and new AR-focused apps, users can explore immersive experiences and practical applications of this cutting-edge technology.

4. Productivity Boosters:

Apple continues to empower users with tools to boost productivity and streamline daily tasks. iOS 17 introduces new productivity features such as enhanced multitasking capabilities, smarter Siri integration, and improved organization tools to help users stay focused and efficient.

5. Performance and Stability Improvements:

Alongside new features, iOS 17 prioritizes performance and stability enhancements. Users can expect smoother animations, faster app launch times, and overall better system responsiveness, ensuring a more enjoyable and frustration-free experience.

• Conclusion:

As iOS 17 rolls out to devices worldwide, Apple reaffirms its commitment to delivering excellence in mobile software. From a sleek new interface design to robust privacy features and productivity enhancements, iOS 17 brings a wealth of improvements to enrich the lives of iPhone and iPad users. With each iteration, Apple continues to raise the bar, cementing iOS as one of the most advanced and user-friendly mobile operating systems on the market.

Unveiling the World of Hackers: Exploring Their Realm

Hackers, the enigmatic figures of the digital age, wield immense power in the virtual world. They possess the skills to penetrate intricate security systems, manipulate data, and even disrupt entire networks. Let's delve into their realm, understanding their motivations, techniques, and impact on our interconnected society.

At its core, a hacker is an individual with advanced computer skills, capable of exploring and exploiting vulnerabilities in computer systems and networks. However, it's crucial to distinguish between different types of hackers, ranging from ethical hackers who aim to improve security to malicious hackers who seek to cause harm.

Read More1. Ethical Hackers:

Ethical hackers, also known as "white hat" hackers, utilize their skills to identify and address security weaknesses within systems. Employed by organizations or working independently, they conduct penetration tests and vulnerability assessments to enhance cybersecurity measures proactively.

2. Malicious Hackers:

Contrary to ethical hackers, malicious hackers, or "black hat" hackers, exploit vulnerabilities for personal gain or to inflict harm. Their motives may vary, including financial gain through data theft, espionage, or causing disruptions for political or ideological reasons.

3. Hacktivists:

Hacktivists combine hacking techniques with activism to promote social or political change. Often operating under pseudonyms, they target government agencies, corporations, or other entities to raise awareness about specific issues or to protest against perceived injustices.

4. Script Kiddies:

Script kiddies lack the technical expertise of seasoned hackers and rely on pre-written scripts or tools to launch attacks. Despite their limited skills, they can still pose a threat by leveraging easily accessible resources to exploit vulnerabilities in systems or networks.

5. State-Sponsored Hackers:

Governments around the world employ skilled hackers to conduct cyber espionage, sabotage, or warfare against adversaries. State-sponsored hackers operate with substantial resources and advanced capabilities, posing significant threats to national security and international stability.

• Conclusion:

In the ever-evolving landscape of cybersecurity, hackers play a central role, shaping the digital world in profound ways. Whether they're ethical hackers striving to fortify defenses or malicious actors seeking to exploit weaknesses, their actions underscore the importance of robust security measures and constant vigilance. Understanding the diverse motivations and tactics of hackers is essential in safeguarding our digital infrastructure and preserving trust in the online realm.

Go Back

Get in touch

We received your message and you'll hear from us soon. Thank You!

How to find us

Corporate Office

Brighton Road, Waldronville, 9018, New Zealand

Email: downeaster2024@gmail.com

© 2024 All Rights Reserved. Designed by DownEaster